stock option tax calculator uk

Taxes for Non-Qualified Stock Options. Since the spread on an NSO is treated as.

16 Ways To Reduce Stock Option Taxes

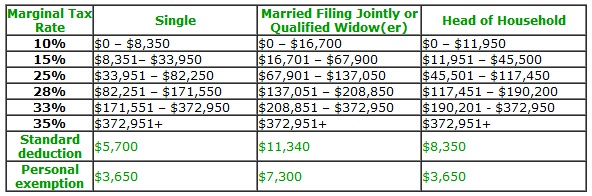

You can find your federal tax rate here.

. This is an online and usually free calculator. Looking to Unlock the Value. Some products and industries necessarily have very high levels of stock turnover.

A FREE optional PDF copy of the guide emailed immediatelyThis means. On this page is an Incentive Stock Options or ISO calculator. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Please enter your option information below to see your potential savings. Equity option positions held for less than a year result in short-term capital gains treatment. The results provided are an.

Net Value After Taxes. Short-term and long-term capital gains tax. This calculator illustrates the tax benefits of exercising your stock options before IPO.

If you exercise an option to acquire vested shares in an unapproved share scheme then you will be liable to UK PAYE and National Insurance on the difference between the. Stock Quotes and Market. Calculate the costs to exercise your stock options - including.

Fast-food outlets turnover their stocks over several times each week let alone. Stock Option Tax Calculator. Once youve opened it you need to provide the initial value at which the asset was bought the sale value at which you have sold it and the duration.

Exercise incentive stock options without paying the alternative minimum tax. The 42 best stock option tax. Online Calculators Financial Calculators Stock Profit Calculator Stock Profit Calculator.

The Stock Option Plan specifies the total number of shares in the option pool. Does anyone have any. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Estimated Taxes From NSOs Due at. Their PAYE is calculated based on the total income amount including the stock option gain but there is also a further deduction stating tax withheld. Once all of the assumptions have been entered the NSO tax calculator will provide three outputs and they are all pretty self-explanatory.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. Lets say you got a grant price of 20 per share but when you exercise your.

The Stock Calculator is very simple to use. The same type acquired in the same company on the same date. The issue of stock options under an advantageous plan should also mitigate any social security payable by both the employee and employer as compared to non-qualifying stock options.

Exercising your non-qualified stock options triggers a tax. You can use the calculator if you sold shares that were. The options were granted within.

Assuming you were like most winners and chose the cash option a 24 federal tax withholding would reduce the 7824 million by 1878 million. As of 2009 the long-term capital gains tax rate is 15 per cent. The Investors Tax Bible - 202 pages of tax saving ideas.

When the option is exercised the option gain is subject to income tax up to 45 in the uk and 37 in the us. Professionally printed by one of the UKs leading book printers. You may be able to work out how much tax to pay on your shares.

XSP Provides Greater Flexibility for Options.

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Best Tax Software Of November 2022 Forbes Advisor

Capital Gains Github Topics Github

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Is Everybody Paying Income Tax Tax Rebate Services

How Many Stock Options Should You Offer Employees This Simple Formula Will Tell You Inc Com

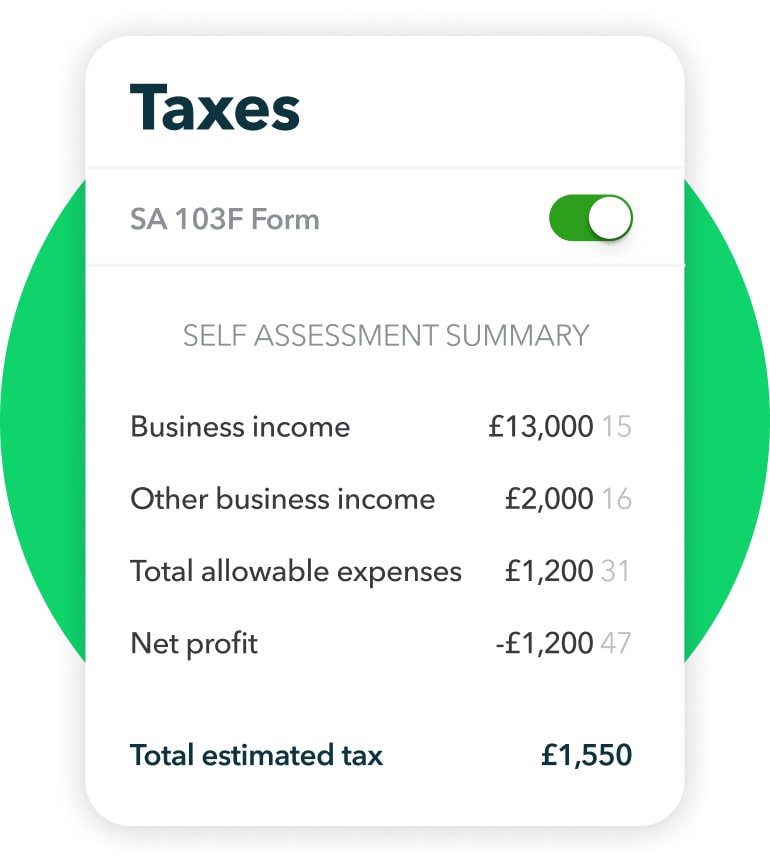

Hmrc Self Assessment Self Assessment Quickbooks Uk

Taxation Of Stock Options For Employees In Canada Madan Ca

How To Size Your Employee Option Pool For Shares Seedlegals

Equity 101 How Stock Options Are Taxed Carta

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Selling Stock How Capital Gains Are Taxed The Motley Fool

2021 Capital Gains Tax Rates In Europe Tax Foundation

Secfi Stock Option Tax Calculator

Crypto Tax Uk Ultimate Guide 2022 Koinly

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista